The UK economy growth faced a challenging quarter as revised official figures revealed zero growth between July and September. With inflation surging at its fastest pace in eight months and the economy shrinking unexpectedly in October, concerns are mounting about the nation’s financial trajectory.

Revised Growth Figures and Economic Challenges

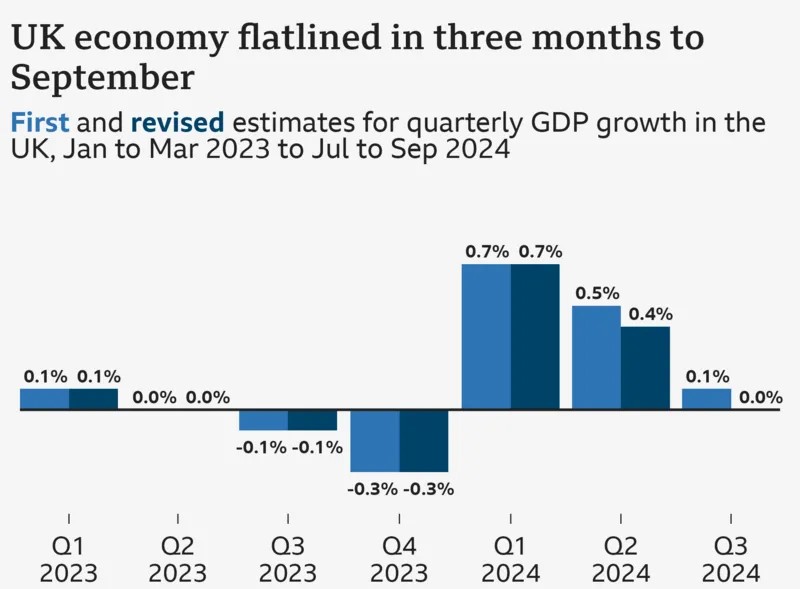

The Office for National Statistics (ONS) released revised data stating the UK had no measurable growth in its gross domestic product (GDP) for the three-month period from July to September. The stagnation paints a bleak picture for an economy already grappling with inflation and cost-of-living pressures.

Adding to the downturn, the ONS also adjusted its April to June GDP growth estimate from 0.5% to 0.4%, citing weaker performance in industries such as hospitality, legal services, and advertising. Liz McKeown, ONS Director of Economic Statistics, remarked that “real household disposable income per head showed no growth,” emphasizing the stagnation affecting household spending power.

Chancellor Rachel Reeves acknowledged the significant challenges ahead for addressing “15 years of neglect,” while Shadow Chancellor Mel Stride criticized the government’s handling of the situation, noting that “growth has tanked” under current leadership.

Businesses Brace for Impact

The Confederation of British Industry (CBI), representing 170,000 firms, warned of a “steep decline in activity” projected for early 2025. Its survey of 899 firms found weak expectations for growth, with Alpesh Paleja, the CBI’s interim deputy chief economist, stating that outlooks “are now at their weakest in over two years.”

Retailers are also preparing for a “January spending squeeze,” as reported by the British Retail Consortium (BRC). CEO Helen Dickinson expressed concern, highlighting that public confidence in the economy “took a nosedive” this month. With sales growth unable to meet costs, Dickinson cautioned that retailers might have to raise prices, cut costs, or freeze recruitment efforts.

The Debate on Recession

Simon French, chief economist at Panmure Liberum, indicated that the revised zero-growth figures align with other indicators showing a slump in economic momentum since the July general election. French raised the question of whether this slowdown is a temporary post-election dip or the precursor to a recession.

According to Paul Dales, chief economist at Capital Economics, the slowdown appears to be influenced by external factors rather than just domestic issues. Dales suggested that even if the UK were to enter a recession, it would likely be “small and short-lived,” as the high rate of household saving may cushion the blow.

The Bank of England recently decided to hold interest rates steady, citing its assessment that the economy underperformed in the fourth quarter, with no growth expected between October and December.

Budget Concerns and Future Challenges

The upcoming Budget measures, set to take effect in April, are drawing criticism from businesses. Changes include increases in employer national insurance contributions (NICs) and a higher minimum wage, which many firms warn could lead to job cuts and price hikes.

Liberal Democrat treasury spokesperson Daisy Cooper called for a reversal of the national insurance tax hike on small businesses and urged the government to replace the current business rates system. Businesses worry that these measures could negatively impact growth and exacerbate current economic challenges.

What Lies Ahead for the UK Economy?

The revised data emphasizes that the UK economy growth is stagnating at a time when businesses and consumers face growing financial pressure. While some experts remain cautiously optimistic, hoping for a short-lived downturn, others see this as a warning of a more prolonged economic struggle.

To keep up with the latest updates on the UK’s financial landscape, follow reputable sources like the Bank of England or the [Office for National Statistics (ONS)](https://www.ons.gov.uk/).